You Are a Local Business

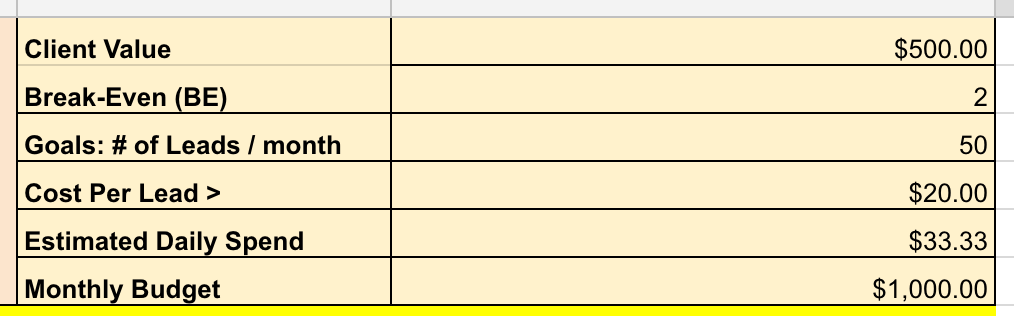

How to determine how much you are willing to spend to get a lead, we are going to use an example of a local business. Now the prices, and varieties are all subject to an estimation but this would be a good point of reference to go from that you can replicate to your business.

How Much Can We Spend To Get a Customer

You have a customer who pays you a fee of $500 for your service for the month. He stays with you for an average of 6 months. Therefore the lifetime value (LTV) of him is about $3,000.

So we are willing to spend up to $500 to Break-Even(BE) to get a customer. So that if that customer stays for the second, third, and sixth month we know that we are making a Return on Investment. So we now know our break-even point. How Much Can We Spend To Get a Lead

So now that we know we can spend up to $500 to break even on one customer. How to determine how much we can spend to get leads?

First, lets say that you can sell 10% of your leads. That means that out of 100 leads you are able to sell 10 of them. These are cold leads, not warm leads. And lets say that you are able to sell 40% of your warm leads, and 65% of your hot leads. Cold leads are people who are not familiar with you or your brand. Warm leads are people who already know you a little bit, and know they have a problem and are aware that you possibly can solve it. And hot leads are already your customers, who paid you money and also know that you can solve problems. Some of them will purchase other services from you. So lets say that you can sell 10% on average of your cold leads. So if you got 100 leads that means you on average sell 10 of them. So doing the math now, you are only able to spend up to $20 to acquire a lead if you are averaging a 10% sales conversion rate from Lead to Sale and if the value of your customer is $500/month. That means that you need to get leads cheaper than $20 per lead to break even!

In the example above comes from one of our clients ads platforms excel sheet. The client has a monthly budget of $1k. That means their break even 2 clients since their client value is $500. So if they get only 2 clients from their $1k ad spend. They break even for the first month and make profit on the second, third month and so on.

Understanding Long-Term ROI

If you can understand the math above, (I know that it can be hard to understand sometimes) that means you know how to accurately measure your break even mark and now you can understand what it takes to scale your FB marketing campaigns.

But how do you measure Long-Term ROI? Well lets say you get those 50 leads but you only sell 5 of them (since your sales conversion rate from lead to sale is 10%). Then once you sell 5 of them, you put the remaining 45 on your email marketing campaigns. They see content from you for a while and then 4 months later you push them an appointment link in the email and they sign up. How can you track that person all the way back to the campaign that you paid for and measure a return because now you went from selling at 10% to possibly 20% over the long term length of lead nurturing. There is a way to do this without having to spending loads of money on tracking softwares. If you're interested I can show you how this works on a private call. Just click here!

|